Enjoy complimentary access to top ideas and insights — selected by our editors.

The Internal Revenue Service, like other government agencies, is a target of thinning and deregulation under the Trump administration and the Department of Government Efficiency, formerly led by Elon Musk. With a new commissioner on the horizon, and everchanging guidelines, here are the latest moves from the IRS.

A campaign to grant Immigration and Customs Enforcement agents access to tax records gained some ground in May, as Treasury Secretary Scott Bessent and Homeland Security Secretary Kristi Noem permitted the IRS to share taxpayer information under very limited circumstances.

In exchange for ICE’s provision of a person’s name, address and deportation order date, the IRS can release taxpayer data — but only for non-tax criminal matters.

Read more: IRS to lose billions if migrants stop filing taxes

The IRS has gone through a host of acting commissioners since Donald Trump took office and following the resignation of former Commissioner Danny Werfel. Douglas O’Donnell succeeded Werfel after his Jan. 20 resignation and retired just one month later.

After O’Donnell was Melanie Krause, who was chief operating officer of the IRS prior to being named acting commissioner in February. She held onto the top spot until her resignation in April, and was followed by Gary Shapley, a former special agent in the IRS’s Criminal Investigation division.

Shapely held the role for two days, ceding it to present acting IRS Commissioner Michael Faulkender.

These moves, combined with mass layoffs, have created an air of uncertainty at the IRS.

According to a recent report from the Treasury Inspector General for Tax Administration, the agency is poised to become more earnest in its use of artificial intelligence during the auditing process in light of the dropped audits from its reduced headcount.

“There have been news reports about audits that are in process or that are even close to being wrapped up being canceled because members of that audit team were let go and they just didn’t have the staff to carry them on,” Anne Gibson, a senior legal analyst at Wolters Kluwer, told Accounting Today. “I imagine we’ll see more of that.”

Read more: DOGE downsizing, IRS commissioner switch complicate tax season

Below are noteworthy changes from the IRS and what accountants need to know.

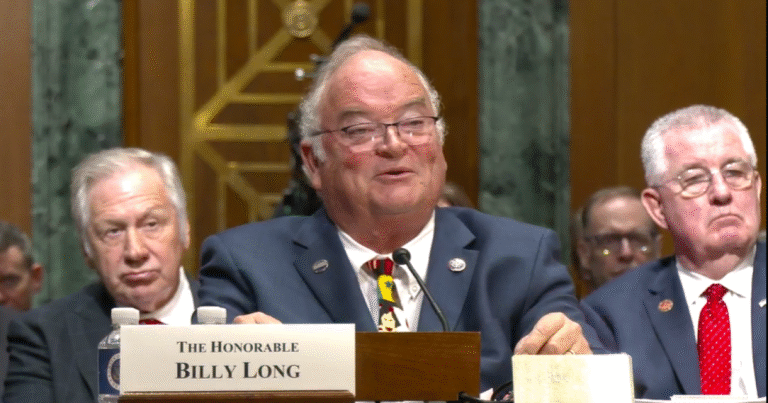

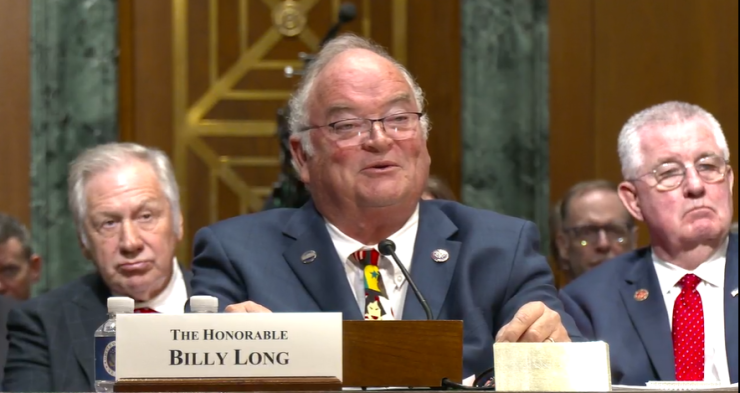

IRS lead nominee Billy Long grilled by Senate Finance panel

Billy Long, the Trump nominee for IRS commissioner, faced probing questions from the Senate Finance Committee on monetary sums earned from promoting tribal tax credits and a failed 2022 Senate campaign, his plans for the agency if confirmed and more.

The former Republican congressman’s December nomination came during then-commissioner Danny Werfel’s term, which was set to conclude in November 2027 but ended when Werfel resigned on Jan. 20. Thus began the revolving door at the head of the IRS and the comings and goings of four acting commissioners.

“I am eager to implement the necessary changes to maximize our effectiveness while also remaining transparent with both Congress and taxpayers,” Long said in his opening statement. “It is important to also recognize the dedicated professionals currently at the IRS whose hard work too often goes unnoticed.”

Read more: Senate panel grills IRS commissioner nominee Billy Long

Samuel Corum/Bloomberg

DOGE cuts oust roughly one-third of IRS auditors

Between layoffs and deferred resignations under the Department of Government Efficiency, the IRS has parted ways with roughly 31% of its auditors.

This announcement follows in the wake of the more than 11,400 employees that were laid off earlier this year as part of the same push from DOGE to curtail perceived overspending from government agencies.

Findings from the Treasury Inspector General for Tax Administration’s recent report concluded that these firings disproportionately impacted various divisions across the IRS, with divisions such as Tax Exempt & Government Entities, Large Business & International and Small Business & Self-Employed all recording double-digit headcount reductions as of March 2025.

Read more: IRS lost 31% of auditors in DOGE downsizing

IRS falls short of improper payment rate benchmark

A report released in May by the Treasury Inspector General for Tax Administration determined that the IRS still has work to do in achieving the goal of the Payment Integrity Information Act.

The 2019 act’s goal directs the IRA to reduce improper payment rates to less than 10% for four refundable tax credits — the Additional Child Tax Credit, the American Opportunity Tax Credit, the Earned Income Tax Credit and the Net Premium Tax Credit. For the 2024 fiscal year, improper payments for the four credits amounted to roughly $21.4 billion.

The rates for each were 29% for the Net Premium Tax Credit, 28% for the AOTC, 27% for the EITC and 11% for the ACTC.

Read more: Improper payment rate still too high at IRS

IRS to slightly raise HSA limits for 2026

IRS executives said the agency will raise inflation-adjusted amounts for health savings accounts in 2026, but only slightly.

Individuals with self-only coverage tied to a high-deductible health plan have an annual limitation of $4,400 for the 2026 calendar year, which is a $100 bump from 2025’s limit.

Other noteworthy increases include the $8,750 annual limitation for individuals with family coverage under a high-deductible health plan and the limits for what defines a high-deductible health plan, which have deductibles not less than $1,700 for self-only coverage (up $50 from 2025) or $3,400 for family coverage (from $3,300 in 2025), and for which annual out-of-pocket expenses (but not premiums) are less than $8,500 for self-only coverage (up $100 from this year) or $17,000 for family coverage (up from this year’s $16,600).

Read more: HSA limits to get a modest bump

Stefani Reynolds/Bloomberg

IRS crackdown on high-income non-filers needs improvement

Officials with the Treasury Inspector General for Tax Administration found that IRS “sweeps” that uncovered instances of high-income people not filing taxes were more productive than their non-sweep counterparts, both in terms of closure rate and dollars collected.

The TIGTA report said that revenue officers were able to bring in between 30% to 68% more on average per HINF sweep case than non-sweep case for tax years 2014 through 2020.

“When people don’t file a tax return they’re required to, it’s not fair to those hardworking taxpayers who responsibly do their civic duty under the laws of our nation,” Danny Werfel, former IRS commissioner, said during a press call last year. “When people don’t file their taxes, they need to know there’s a consequence, [and] this is why I was particularly troubled to learn when I became commissioner that the IRS had to back off our core compliance work on non-filers.”

Read more: IRS faces issues in crackdown on high-income non-filers