The Internal Revenue Service has released a draft version of the 2026 Form W-2, Wage and Tax Statement, with new fields added to prepare the way for the tax exemptions on tips and overtime income under the One Big Beautiful Bill Act.

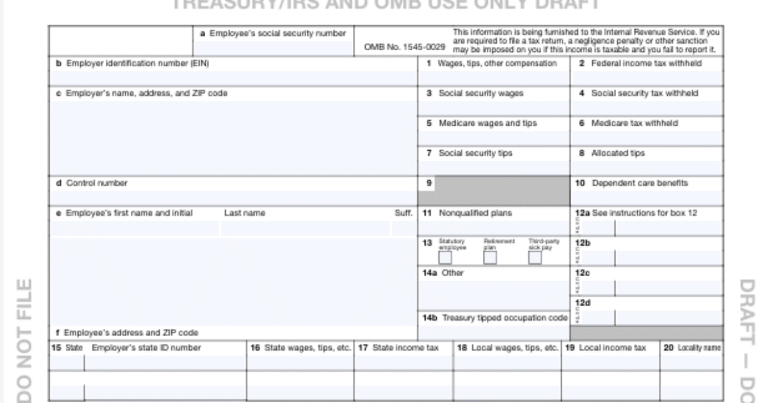

The draft form breaks up Box 14 into two separate boxes, 14a and 14b. Box 14a, like the 2025 form, is labeled Other, but 14b is labeled “Treasury tipped occupation code.” The Treasury Department is expected to announce a list of qualifying occupations that are eligible to claim the “no tax on tips” deduction by Oct. 2. The deduction is for qualified tips of up to $25,000 per year and phases out above $150,000 for a single taxpayer or $300,000 for a joint filer.

The instructions for the draft form say of Box 14b: “Employers use this box to report the Treasury Occupation Code for your tipped occupation. Use this code in reporting the deduction for qualified tips on Sch. 1-A (Form 1040).” For box 12, new codes have been added for tips and overtime pay. The code TP corresponds to “Total amount of qualified tips” and the instructions say to “use this amount in determining the deduction for qualified tips on Sch. 1-A (Form 1040).”

Another code for Box 12 is “TT for the “Total amount of qualified overtime compensation.” Filers are instructed to “Use this amount in determining the deduction for qualified overtime compensation on Sch. 1-A (Form 1040).”

The maximum annual deduction for overtime pay is $12,500 for single taxpayers and $25,000 for joint filers. The deduction phases out for single taxpayers with modified adjusted gross income over $150,000, or $300,000 for joint filers.

The changes are for the 2026 forms, but the provisions also apply to this year. The IRS announced earlier this month that it’s not planning to change Forms W-2 and 1099 and withholding tables for 2025 as a result of the new tax law. However, the tax exemptions on tips and overtime are effective for 2025 through 2028, so taxpayers and tax professionals will need to make the appropriate adjustments when taxes are filed next year even if the withholdings aren’t up to date.