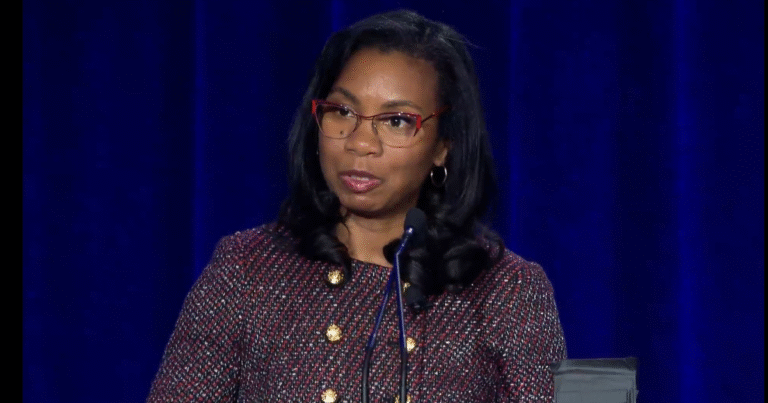

Public Company Accounting Oversight Board chair Erica Williams is departing next Tuesday, July 22, after her agency narrowly avoided an effort to eliminate it by transferring its responsibilities to the Securities and Exchange Commission.

Last month, the Senate Parliamentarian rejected a provision in the One Big Beautiful Bill Act that would have folded the PCAOB and handed its responsibilities to the SEC, although it was part of the version of the bill passed by the House. Williams has fiercely defended the need for the PCAOB to continue to exist as a separate entity and her departure revives the possibility that the PCAOB may succumb to the Trump administration’s efforts to shrink the size of the federal government and its regulatory apparatus.

Williams was originally sworn in as PCAOB chair in January 2022 during the Biden administration. She was subsequently reappointed in June 2024 and sworn in again on Oct. 24, 2024. She was urged by former SEC chair Gary Gensler to update the old auditing standards inherited by the PCAOB after it was created by the Sarbanes-Oxley Act of 2002 and to make its inspections and enforcement tougher. Under her leadership, the PCAOB developed and executed an ambitious strategic plan to modernize standards, enhance inspections, strengthen enforcement and improve the PCAOB’s organizational effectiveness. Gensler stepped down on President Trump’s Inauguration Day and was succeeded by SEC chair Paul Atkins, who was more critical of the PCAOB during an earlier tenure as an SEC commissioner.

“The dedicated staff of the PCAOB are among the most talented and hardworking professionals with whom I have had the opportunity to work, and it has been my honor to serve alongside them,” Williams said in a statement Tuesday. “The PCAOB plays an essential role in protecting the investments and retirement savings of workers and families across the country while helping to ensure our capital markets remain the envy of the world. With high economic uncertainty increasing the risk of fraud, the PCAOB’s mission is as important as ever. It’s critical the expert PCAOB staff continue to be empowered to carry out their work of ensuring American investors are protected.”

The PCAOB listed several of Williams’ accomplishments during her tenure, which included:

Securing complete access to inspect and investigate firms headquartered in China for the first time in history and bringing record enforcement actions against China-based firms;Launching a concentrated effort to improve audit quality that helped lead to significant improvements in deficiency rates across audit firms;Increasing transparency in inspection reports and getting those reports out nearly a year sooner so that investors, audit committees, and others have access to valuable information more quickly;Taking more formal actions to modernize standards and rules than any Board since the PCAOB was created, finalizing seven projects, covering 24 rules and standards;Delivering record-setting sanctions, sending a clear message that there will be strong consequences for anyone who puts investors at risk;Partnering with staff to make the PCAOB a better place to work, leading to a 30-percentage point increase in the number of PCAOB staff who say they would recommend the PCAOB as a great place to work;Reimagining stakeholder outreach, reconstituting the Investor Advisory Group and the Standards and Emerging Issues Advisory Group and creating the first-ever standalone Office of the Investor Advocate; andAwarding the highest amount of merit-based scholarships to accounting students in PCAOB history.